- Peoria Unified School District

- Financial Transparency and Accountability

-

The Peoria Unified School District has long been a leader in providing financial transparency and accountability to the taxpayers in our community. As a district we comply with all federal and state laws and guidelines so that the public can verify that funds are being spent where they best support student success. Listed below are the top ten measures we follow to ensure transparency and how local charter and private schools stack up.

TOP TEN WAYS PEORIA UNIFIED PROVIDES FINANCIAL TRANSPARENCY AND ACCOUNTABILITY

FINANCIAL ACCOUNTABILITY MEASURE PEORIA UNIFIED CHARTER SCHOOLS PRIVATE SCHOOLS Follow Uniform System of Financial Records YES Annual External Financial Audits YES YES Arizona Auditor General Performance Audit YES Arizona Auditor General Classroom Spending Report YES Food Service Compliance Audits YES Only if accepting

federal food fundingAnnual Comprehensive Financial Report YES Annual Financial Report Posted Online YES YES Follow Arizona and Federal Procurement Laws YES YES Regularly Scheduled Public Governing Board Meetings YES Comply with Public Records Requests YES YES

District Spending Analysis for Fiscal Year 2023

-

Each year since 2001, the office of the Arizona Auditor General has released an analysis of Arizona school district spending at both the State and individual district level. The analysis provides insight into total spending, instructional spending, per-student spending, average teacher salaries and district efficiency. Peoria Unified is proud to share the report with our community as part of our efforts towards financial transparency and accountability.

Below are some of the highlights of the FY2023 report. You may access the entire report directly on the Auditor General website or download a PDF copy for offline reading. For our community members who access information through a screen reader, there is a screen reader compatible PDF copy as well.

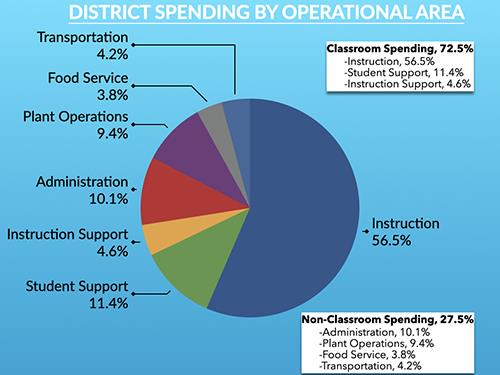

District Spending by Operational Area

Instructional Spending Percentage

-

54.9% Lowest Fiscal Year (FY 2015)

-

61.9% Highest Fiscal Year (FY 2001)

-

56.5% Current Fiscal Year (FY 2023)

-

57.1% Prior Fiscal Year (FY 2022)

Recognized for Financial Reporting Excellence

-

Peoria Unified received the Certificate of Achievement for Excellence in Financial Reporting from the Government Finance Officers Association (GFOA). The Certificate of Achievement was granted for the district’s Annual Comprehensive Financial Report for the fiscal year that ended June 30, 2022.

The Certificate of Achievement is the highest form of recognition in governmental accounting and financial reporting and represents a significant achievement by the district. The award also reflects a high level of commitment to fiscal integrity and management. What makes this award so significant is that it compares the district to other governmental agencies and subdivisions of the state, not just to other school districts. It maintains that the district effectively manages and reports our fiscal responsibility to our community.

Peoria Unified is also celebrating its 33rd consecutive year of earning the Certificate of Excellence in Financial Reporting (COE) award, granted by the Association of School Business Officials International (ASBO).

Peoria Unified earned the Certificate of Excellence for its Annual Comprehensive Financial Report (ACFR) for the fiscal year that ended in 2022. ASBO International Chief Operations Officer and Interim Executive Director, Siobhan McMahon shares, “The Annual Comprehensive Financial Report informs stakeholders about the financial and economic state of the district, making it an important communications tool for building trust and engaging with the school community.”

Bond Refunding Program Saves Taxpayers $5.6 Million

-

At the March 14, 2024, Governing Board meeting, the Peoria Unified Governing Board voted 4-0 to approve the district to pursue a bond refunding related to prior bond sales in 2012, 2013 and 2014 that have become callable for early redemption.

The voter approved 2012 Bond Authorization provided $180 million dollars in funding to Peoria Unified and supported critical initiatives such as facility renovations, technology upgrades and bus purchases. The bond program was in place for ten years and is now complete.

As of June 30, 2023, the district had $153,065,000 in outstanding bond related debt, of which $55.2 million in bonds have been identified as eligible for a refunding in 2024.

Bond refinancings or “refundings” are used by state and local governments to achieve debt service savings on outstanding bonds. The district most recently completed a bond refunding in 2015.

Recognizing the potential for debt service savings that directly benefits community taxpayers, the district initiated a 2024 bond refunding that is estimated to have a $4,859,732 of net present value savings (8.8% of refunded principal) and $5,672,205 of future value savings, with an all-in true interest cost of 2.99%, pending the April 11, 2024 closing date. Another benefit is that the 2024 refunding does not extend the original amortization timeline of the previously sold bonds.

The Peoria Unified School District remains committed to transparency and accountability in all financial matters and was recently reaffirmed with a AA- credit rating from S&P. The district’s credit worthiness has made the 2024 bond refunding possible.Watch the presentation from the March 14, 2024 Governing Board Meeting