- Peoria Unified School District

- Past Elections

- 2024 Bond Election

Bonds & Overrides

Page Navigation

-

As of November 22, 2024, results indicate the Peoria Unified bond will not pass. While the results are not what we were expecting, we will keep our staff and community updated with how we plan to navigate the year ahead to address our growing capital needs and adjust our plans to support the learning environments that our students deserve.

2024 Bond Election

-

On May 9, 2024, the Peoria Unified Governing Board voted to follow the recommendation of the Citizens’ Advisory Committee to call for a $120 million bond authorization in the 2024 General Election.

If approved, the bond is not expected to be a tax rate increase. The projected average additional tax rate per $100 of limited assessed valuation is $.27.

The Citizens’ Advisory Committee (CAC) provided their recommendation to the Governing Board after conducting public meetings and a study of current and future facility and capital needs. With voter approval, the Peoria Unified School District may issue bonds, similar to a mortgage or line of credit, to fund projects that have a useful life longer than five years.

The 2024 bond election includes the following:

How will the dollars be used: Amount: Safety and Security $15,500,000 Priority repairs and upgrades to elementary and high schools $57,200,000 New elementary school construction $21,000,000 District facility priority safety upgrades and security $3,700,000 Technology $10,000,000 Transportation $12,600,000 Total: $120,000,000

-

What do I need to know about the bond election?

Voters will decide on the Peoria Unified bond question in the general election to authorize Peoria Unified to sell up to $120 million dollars in bonds to maintain existing facilities, increase safety and security, upgrade technology, and purchase additional school buses. The bond will include funds for a new elementary school. The school district has solicited input from the community to determine the capital improvements included in the bond program.

Election day is on November 5, 2024. Those who have requested to vote by mail will receive their ballot the first week of October.

-

What will happen if the bond is not approved?

If the bond is not approved, the district will not be able to fund certain safety and security enhancements, maintain all of its current assets, build a new elementary school, upgrade district facilities for additional safety and security, fund additional technology and transportation needs, like student and staff computers and school buses. Without bond funding, many major projects that focus on school safety, security, and growth cannot be started, often putting school districts years behind residential growth trends.

-

What is a bond authorization?

Arizona Revised Statute 15-491 allows a district’s Governing Board to ask voters to approve the school district to issue bonds, which are purchased by investors, to fund projects that have a useful life longer than five years. Similar to a mortgage on a home, the district borrows money through the bond sales and repays them sales over time with interest. The money can be used for things like buying or leasing school land, buildings and grounds, school furniture, equipment, technology, and transportation vehicles. Bonds cannot be spent on daily operational expenditures, such as teacher salaries. Examples of building improvements include (heating, air conditioning, roofing, and lighting), technology (computers), school buses and related equipment.

-

What is the cost to the average taxpayer?

The proposed $120 million bond authorization bond sales will be structured so that there will be no expected tax rate increase to the community. The combined tax rate of outstanding and proposed new bonds is projected to be at $.57 per $100 of limited assessed valuation. The impact of the bond on taxes will depend on the assessed value of each taxpayer's property. The district encourages all taxpayers to enter the specifics from their individual property tax statement into the district’s property tax calculator for an estimate of the tax amount for their home.

-

If the bond is approved, why is there no expected tax rate increase?

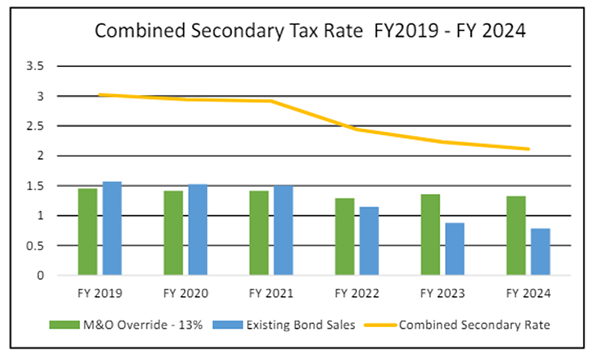

Bond programs and M&O Overrides that are approved by the voters are supported by secondary property taxes in the district. The district has had a priority focus on the district’s property tax rate, which has been declining in recent years.

The chart below shows how the district has had a decreasing tax rate over time:

FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 Primary Tax Rate 3.9990 3.8591 3.7467 3.7238 3.5363 3.3950 M&O Override - 13% 1.4531 1.4163 1.4123 1.2948 1.3553 1.3295 Existing Bond Sales 1.5671 1.526 1.5045 1.448 0.8758 0.7974 Combined Secondary Rate 3.0202 2.9423 2.9168 2.4396 2.2311 2.1269 The tax rate related to current outstanding bond sales in FY 2025, will be $.58 per $100 of Limited Assessed Value, which continues the property tax rate decline detailed in the above chart. This is due to outstanding bonds sales continuing to be paid off and the assessed value of property in the district continuing to increase. If the new bond program is approved by the voters, the FY 2026 property tax rate will be $.57 per $100 of Limited Assessed Value and is based on current and projected property values and the district’s current plans for issuance of new bonds. The projected average additional tax rate per $100 of limited assessed valuation is $.27.

-

How can I view the changes in secondary property taxes and how the bond will change the tax rate?

The following table will be in the Voter Information Pamphlet for community members to review showing the expected tax rate for each year for currently outstanding bonds and the proposed new bonds:

-

What are some more specific examples of how the district will spend the bond dollars, if approved?

Safety and Security Improving the safety features on district campuses to ensure safe learning environments for all students and staff. Examples of safety and security upgrades at elementary and high schools include front office remodels, fencing, and cameras. Priority repairs and upgrades to elementary and high schools Upgrade and maintain all district elementary and high schools including the integrity of structures and systems. This includes heating, air conditioning, roofing, electrical, plumbing, foundation repairs, parking lots and related projects. New elementary school construction Construction of a new elementary school on an existing parcel of land that is owned by the district to provide an additional learning environment to meet the needs of today’s students. District facility priority safety upgrades and security Renovations and/or improvements to and for administrative facilities and grounds, including safety, technology, furniture and equipment. Technology Technology, equipment and infrastructure related to access and connectivity to equip district campuses with the most up-to-date technology through technology replacements, improvements and upgrades. This includes student and staff devices and computers. Transportation Student transportation and campus support vehicles including yellow school buses. The 2024 bond would fund construction and upkeep of school campus buildings, the maintenance of energy-efficient, safe and secure campuses, state-of-the-art technology to support student learning, the maintenance of the district’s bus fleet, and a new school to support student growth in the northern part of the district.

-

If approved, where will the new elementary school be built?

If the bond initiative is approved, a future elementary school will be built on one of four parcels of land owned by the district. The district will conduct an assessment and look at multiple data points prior to selecting which of the four parcels is the best location for a new school.

-

Why isn’t the construction of a new high school included in the bond initiative?

A Peoria Unified high school in the northern portion of the district is not included in the proposed bond. During their review, the Citizens’ Advisory Committee asked for data from a demographic study which was conducted to analyze the growth in the northern portion of the district. Although Liberty High School is currently at capacity, its enrollment is expected to remain flat for the next seven to 10 years. This is due to inflation, the increasing cost of homes, lower birth rates, and the recent announcement of a charter high school expected to break ground in Vistancia. Without an immediate need for a new high school, including this in the proposed bond authorization was not a top priority for the Citizens’ Advisory Committee.

-

Why doesn’t the district use its current dollars to fund these projects?

Between 2007 and 2021, the State did not fully fund the capital formula created by the State of Arizona. While the legislature has restored the funding formula, the per-student amount in the formula remained unchanged from 1998 through 2022 and is not indexed for inflation.

Over the last three years, the district has invested more than $38,000,000 to fund critical safety needs, building maintenance and repairs in the district. A number of these projects were paid for from remaining 2012 Bond dollars. The district does not currently have a bond program and annual capital funding from the state of Arizona is not at a level to address the projects that have been identified as a priority over the next several years to maintain safe and functioning learning environments for students.

-

How were these projects identified?

The district convened a Citizens’ Advisory Committee comprised of district stakeholders, which held public meetings from January through April 2024. The Committee considered the district’s current priority projects, security, technology, transportation and related needs. They also reviewed the district’s budget, current tax rate, bonding capacity, demographics, enrollment projections, current maintenance and operations override and input from a public opinion survey. They also received information on the district’s past 2012 bond program that was completed in FY 2023.

One of the key pieces of data the Committee reviewed was the district’s facility assessment study from 2020. The study identified $301 million in short-term and long-term capital needs with $119 million of this amount being considered a critical need that can shut down or impact the learning environment at a school, such as roofing, HVAC, fire/life safety systems, lighting, electrical, plumbing flooring and wall structures. Since 2020, the district has invested $38,167,415 to support these projects and created a Capital Improvement Plan to align priorities with available funding sources. However, a bond program will be necessary to address all of the priority projects over the next several years.

The Committee reviewed potential bond scenarios from $75 - $325 million, but it was noted that bond scenarios up to $120 million could be realized without a tax rate increase. At the conclusion of the Committee’s evaluation, they made a recommendation that the Governing Board should call for a $120 million dollar bond authorization. Minutes from all seven of their public meetings can be found in BoardDocs on the district’s website.

-

When is the last time the Peoria Unified School District had a bond authorization in place?

The district has not had a bond authorization since 2012. All bonds have been fully sold and expended under this program. The details on how the dollars were spent can be found here.

-

What measures will be put in place to ensure transparency and accountability in how bond funds are spent, including independent audits?

The district will have several mechanisms in place to share information in a transparent and accountable way with our community:

- An Information Report agenda item at each Governing Board meeting related to individual bond funded facility maintenance, upgrades and construction projects, Purchase Orders and project status to date.

- A list of completed bond projects by school and location on the district’s website.

- As required by state statute annually, a public meeting for administration to provide an update to the Governing Board and Community on the status of the bond program including the cost of construction, capital improvements and the status of the bond program to date, remaining bond sales, remaining bond proceeds in comparison to the categories, projects and dollar amounts that were approved by the voters in the bond election.

- The district is required to have an annual financial audit by a Certified Public Accounting Firm each year. The audited financial statements are available to the public on the district’s website and there is an annual audit presentation to the Governing Board each year.

- Each October, the district makes an annual presentation to the community detailing how bond funds were spent. View the presentations.

-

Do other school districts also ask their communities to approve voter initiatives?

Yes. This November the two largest neighboring preK-12 public school districts to Peoria Unified, the Deer Valley and Dysart school districts, will also have an initiative on the ballot.

-

How do I get additional information on how the district spends its current budget?

The district posts its last 10 years of annual budgets, expenditure reports and audited financial statements on the district’s website. Search our financial documents here.

-

* Tax rates stated per $100 of net limited assessed value without adjustment for earnings, arbitrage or delinquencies. Estimated annual tax rate decline for new bond scenarios is based on current and projected property values and the District’s current plans for issuance of bonds.