- Peoria Unified School District

- 2025 Override Election

- Property Tax Calculator

Bonds & Overrides

Page Navigation

Property Tax Calculator

-

ESTIMATED TAX IMPACT OF A NEW 15% MAINTENENACE AND OPERATIONS OVERRIDE

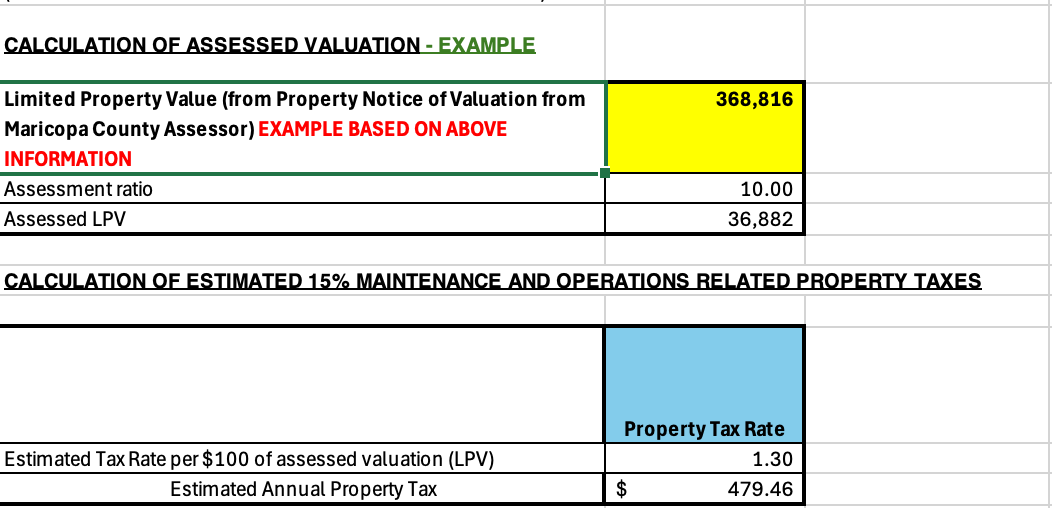

The 15% Maintenance and Operations Override will be paid from a levy of ad valorem taxes on all taxable property within the Peoria Unified School District. This will result in an estimated average annual tax rate of $1.30 per $100 of limited assessed valuation for residential property owners.

PROPERTY TAX CALCULATOR EXAMPLES AND REQUIRED INFORMATION

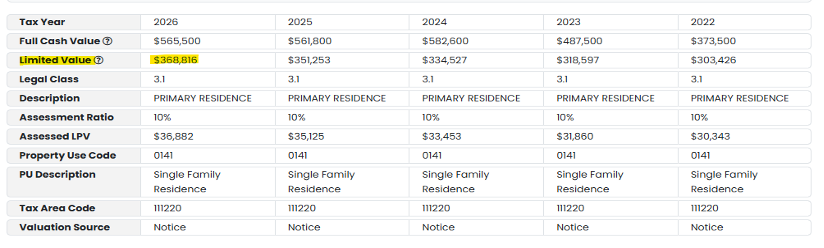

The calculator below will calculate your estimated Peoria Unified School District 15% Maintenance and Operations Override program related property taxes. To use the calculator, you will need the limited property value of your property. This is not the current fair market value of a home but rather the Limited Property Value as calculated by the Maricopa County Assessor. This amount can be located on the Property Notice of Valuation that is mailed each year from the Maricopa County Assessor or online by visiting the Maricopa County Assessor website.

Once on the website, you can search for your property either by parcel number or street address and then review the valuation information.

This example Peoria home has an approximate fair market value of $687,700 if it were to be listed for sale on the open market.

The estimated 15% Maintenance and Operations Override related tax on the example home is $479.46 annually.

(Assumes 2026 and 2027 assessed valuations are the same.)

Interactive Calculator - Enter Your Information Here

-

- Tax rates stated per $100 of net limited assessed value without adjustment for earnings, arbitrage or delinquencies.